Millage Down, Bill Up: What Changed On Your 2025 Tax Notice

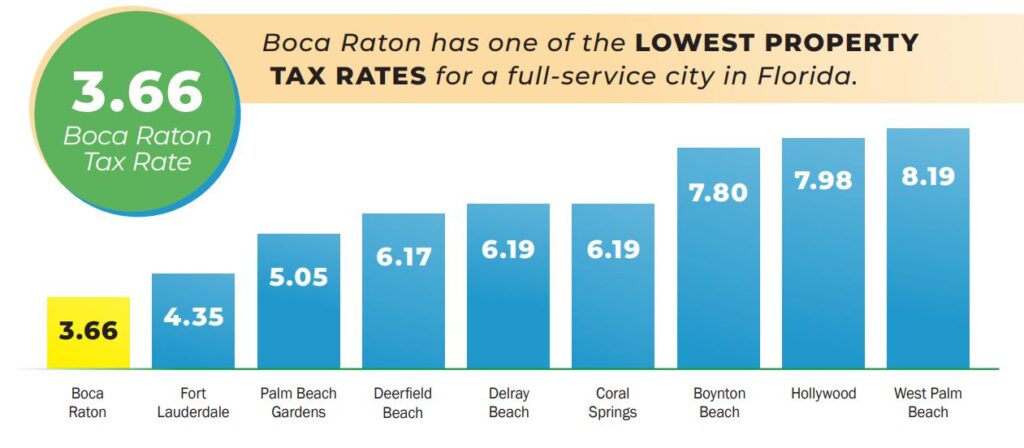

BOCA RATON, FL (Boca Post) (Copyright © 2025) — If you opened your 2025 tax notice and saw a bigger number, you’re not alone. The City’s millage actually fell to 3.6649, but many homeowners will still pay more because the taxable value of property jumped and because the City is only one piece of the total bill.

Here’s the core math. The County Property Appraiser certified Boca Raton’s taxable value at $40,204,647,451, up $2.81B (+7.51%) from last year. That lift alone means the City expects about $141.45M in ad valorem—roughly $9.03M (+6.8%) more than FY 2024–25—even with a slightly lower rate. Reassessments account for most of the increase (+5.56%), with new construction adding +1.95%.

What you actually pay to the City. Using the City’s example of a $450,000 taxable value, the City line comes to $1,649.21 this year. The separate Fire Assessment remains $155 per home.

But your total bill is bigger than just the City. The consolidated 2025 example shows $7,810.16 in total ad valorem at a combined millage of 17.0047, with the City representing 21.55% of that stack. The largest shares are the School Board and the County.

Why many Boca bills are higher anyway

- Values rose faster than the rate dropped. Citywide taxable value grew 7.51%; the total City millage fell only 0.0085 mills year-over-year. Net effect: more dollars from roughly the same rate.

- The City is ~1/5 of your bill. Even if the City trims its slice, changes by other taxing authorities (School Board, County, special districts) can pull the total up. In the City’s example, Boca’s share is 21.55% of the millage stack.

- Reassessments vs. new construction. Most of this year’s tax-base jump is reassessments (+5.56%), meaning existing properties were valued higher—so notices rose for many long-time owners.

- Fixed assessments don’t fall with millage. The Fire Assessment is a flat $155 per home this year; it doesn’t track the millage rate.

- Small citywide rate change, big base. The total millage (operations, CIP, debt) nudged down again to 3.6649—continuing a multi-year trend—but the base is much larger, which increases total collections.

What the City controls (and what it doesn’t)

- Controls: City millage (Operations, CIP, Debt), City fire assessment, City fees and utility/franchise revenue policies. The City notes utility taxes are at 10% (state max), with portions dedicated to Beautification and the six-year CIP.

- Doesn’t control: School Board, County, special districts, or how the Property Appraiser values property.

Quick example: How a $450,000 notice stacks up

- City of Boca Raton (3.6649 mills) → $1,649.21

- All taxing authorities combined (17.0047 mills) → $7,810.16 (ad valorem only; add the $155 City fire assessment on top).

For more, the City points residents to “2025 Your Taxes Explained,” which breaks down who taxes what on a typical bill.

What to watch next

The City’s General Fund relies on ad valorem for about half of revenues, so swings in values matter. Meanwhile, the overall city budget totals $847.35M across all funds this year.

0 Comments