DELRAY BEACH, FL (Boca Post) (Copyright © 2026) — Delray Beach has adopted its Fiscal Year 2025–26 budget, approving a $423.9 million operating plan that city officials say keeps investments moving in public safety, infrastructure, parks and recreation, economic vitality, and other core services.

The budget was adopted Sept. 15, 2025.

City leaders are also using the rollout to answer a question that comes up every year when TRIM notices land in mailboxes: where does the property tax money actually go, and how much of it stays with City Hall?

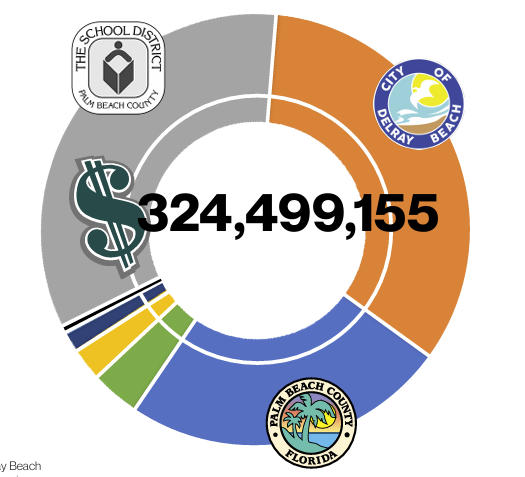

The city’s breakdown says Delray Beach residents pay property taxes to multiple agencies, not just the city government. In 2024, the total property tax contribution by homeowners was listed at about $324.5 million, with the largest shares going to the School District of Palm Beach County and the city itself.

The figures show roughly 36.32% of those taxes went to the School District of Palm Beach County, or about $117.85 million. The city’s share was listed at 32.49% — about $105.44 million — for operating costs and debt. Palm Beach County’s portion was 23.80%, or about $77.24 million. Smaller shares went to the Health Care District (3.45%, about $11.20 million), Children’s Services Council (2.58%, about $8.38 million), South Florida Water Management District (1.21%, about $3.93 million), and the Florida Inland Navigation District (0.14%, about $0.46 million).

In other words: even though the city provides many of the day-to-day services residents think of first — police and fire-rescue, parks, roads, and the routine stuff that keeps a city moving — the city says it receives just under one-third of a typical residential tax bill.

City officials also pointed to a decade-long trend of lowering the millage rate when the numbers allow. The budget document describes that as a consistent commitment by the City Commission, built on conservative revenue forecasting, disciplined budgeting, and long-term planning.

One local wrinkle is fire costs. The city notes it does not collect a fire assessment fee like some neighboring communities. Fire services are included in the operating millage rate instead, rolled into the same pot that covers the rest of city operations.

The city provided an example of what the city portion looks like for an “average” homeowner, using an average taxable value of $447,888. In that illustration, the city portion of the tax bill rises from $2,660 in FY 2024–25 to $2,773 in FY 2025–26 — an increase of $113 — even as the city discusses millage reductions over time.

Once city property tax dollars are in the door, Delray Beach says the spending priorities are heavily weighted toward safety and emergency response.

For every $1 in city property taxes, the city’s breakdown allocates $0.54 to Public Safety, including police services, fire-rescue, emergency response, and community protection. Another $0.20 goes to Buildings, Grounds & General Government — the internal machinery: facility maintenance, administration, and support functions. The remaining dollars are split evenly: $0.13 to Recreation, Culture & Human Services, and $0.13 to Economic Environment, which includes planning, zoning, development services, permitting, and business support.

The $423.9 million operating budget funds a full menu of services, including public safety staffing and equipment, maintenance of more than 60 public buildings, parks, and facilities, water and wastewater operations, roadway and stormwater infrastructure, libraries and recreation programs, and core municipal administration. The city also describes a General Fund allocation meant to support citywide services while maintaining responsible reserves.

The budget document outlines the major buckets used to manage city money — including the General Fund, enterprise funds for utilities that charge fees, internal service funds used for support departments like fleet and technology, debt service funds, and special revenue funds tied to specific purposes like grants or dedicated impact fees.

There are big numbers tied to that safety focus. Delray Beach lists a $107 million public safety operating budget, including 174 police officers, 164 firefighters, and 94 civilians, with five fire stations and eight ocean rescue towers. The city says it has 1,070 employees in total, including seasonal and part-time positions.

The city also highlights broader financial stats: an assessed value of $19.6 billion, total property taxes of $120.6 million (including the DDA), and a bond rating of AA+. It pegs the city’s population at about 68,650 across 17.4 square miles, noting that 98.9% of the city has been developed.

Bottom line, officials are trying to sell steadiness. Keep the lights on, keep the trucks rolling, keep the beach towers staffed, and keep Delray Beach running — while explaining, in plain terms, who gets what from the property tax bill and what the city does with its slice.

Source: City of Delray Beach, “Your Taxes Explained” (Delray Beach’s FY 2025/26 Budget – City Finance Magazine), delraybeachfl.gov

One thing I can’t get a straight answer on it who’s paying for that fire truck? He got hit by a Brightline train because of a unlicensed driver to Delray Beach is one fire truck short for several million dollars